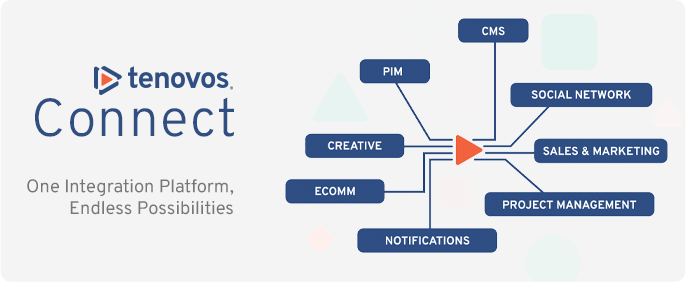

Tenovos was built by digital asset management users and experts who demanded more out of their platform. Tired of counterintuitive UI, sluggish performance, lack of integrations, declining innovation, and, most importantly, an absence of data and insights, we decided to build a new kind of DAM from the ground up with the latest technology.

Our mission is simple. To help brands simplify the complexities of managing global content and provide unique content productivity and performance insights that allow teams to tell relevant and engaging “stories” to their audience.